December 31, 2021

DAOs will mitigate Artificial Intelligence’s negative impacts

By now, most are aware of the bad outcomes we see in our ad-based economic model today. Of these, lacking privacy and poor consumer data ethics are most relevant. Organizations are incentivized to get your data by any means necessary. With that data, they use algorithms to increase the “stickiness” of their platform and sell you products. What initially seemed not-so-bad has morphed into a business model that takes advantage of people’s innate biological tendencies and desires. As a result, we’ve seen social phenomenons like filter bubbles, tribalism, and mental health issues. Under an Ad-based economic model, AI is built solely to take advantage of humanity; to deceive it, and ultimately to destroy it.

For the past decades, many have speculated that Artificial Intelligence (AI) is among the biggest threats to humanity. Elon Musk and Stephen Hawking are just two of many highly respected intellectuals that theorize its dangers. And these theories are based on the premise that we may one day lose our authority over machines. As Microsoft CSO Eric Horvitz puts it; “we could one day lose control of AI systems via the rise of superintelligences that do not act in accordance with human wishes — and that such powerful systems would threaten humanity.”

Among the most recent growing trends in crypto, blockchain, Web3, dWeb (whatever your preference) is the emergence of DAOs that govern protocols and communities with common incentives. Ethereum was the first to start “The DAO” which ended in a smart contract hack that led to a network fork, and the original Ethereum chain was renamed Ethereum Classic. The purpose of The DAO was to transparently provide capital funding for Ethereum’s projects and manage the rules surrounding the protocol.

DAOs require blockchain as a common point of truth and a no-trust-required distributed database. The ability to govern protocols and rules for how a digital entity acts is the primary use-case of a DAO. Many in the blockchain space already know the power of DAOs, but many outside seem to be oblivious to its ability to govern technologies that may threaten or harm humanity; technologies like AI, whether in the form of algorithms, robotics, artificial neural networks, or almost anything digitally-native.

If through DAOs, humans have the ability to govern a digital entity’s behavior, one has to ask, can we govern AI in a decentralized way, and would it prevent the possibility of an adversarial AI? The issue with this premise is that many will continue to build ungovernable autonomous AIs regardless of any regulations, thus the solutions may have more to do with checks and balances within the market. To create these checks and balances, the collective power of DAO-governed AIs must be greater and/or faster than autonomous AIs.

Outside of possible regulation to slow down the pace of autonomous AIs, DAO-governed-AIs would have the ability to keep autonomous AIs in check and mitigate its dangers in the long term. But how might we get there?

First off, sharing input (voting) in a DAO has to be as quick and cheap as possible. Current Ethereum gas prices make it difficult to cast votes in a cost-effective manner, and the speed of confirming a transaction is slow. Many DAO tool providers are cognizant of this issue and have strategically positioned themselves based on scalability expectations. Most scalability speculators have two major outlooks; that blockchain will scale vertically through Ethereum, or horizontally through other blockchains like Cosmos or Polkadot.

Overall, blockchain use is expected to follow both axises of scalability in the coming years, and the prevalence of using a specific blockchain may not be as important as its virtual machine compatibility, to which the Ethereum Virtual Machine (EVM) is currently the most popular. In other words, it might not matter which blockchain is under the hood, especially for the average user.

Another requirement for DAOs to combat the negative effects of AI is that voting has to be as fast and effortless as a simple thought. The pace of autonomous AI decision making may be immediate. Thus, its negative decisions could badly hurt humanity if the time required to correct that bad decision is too large.

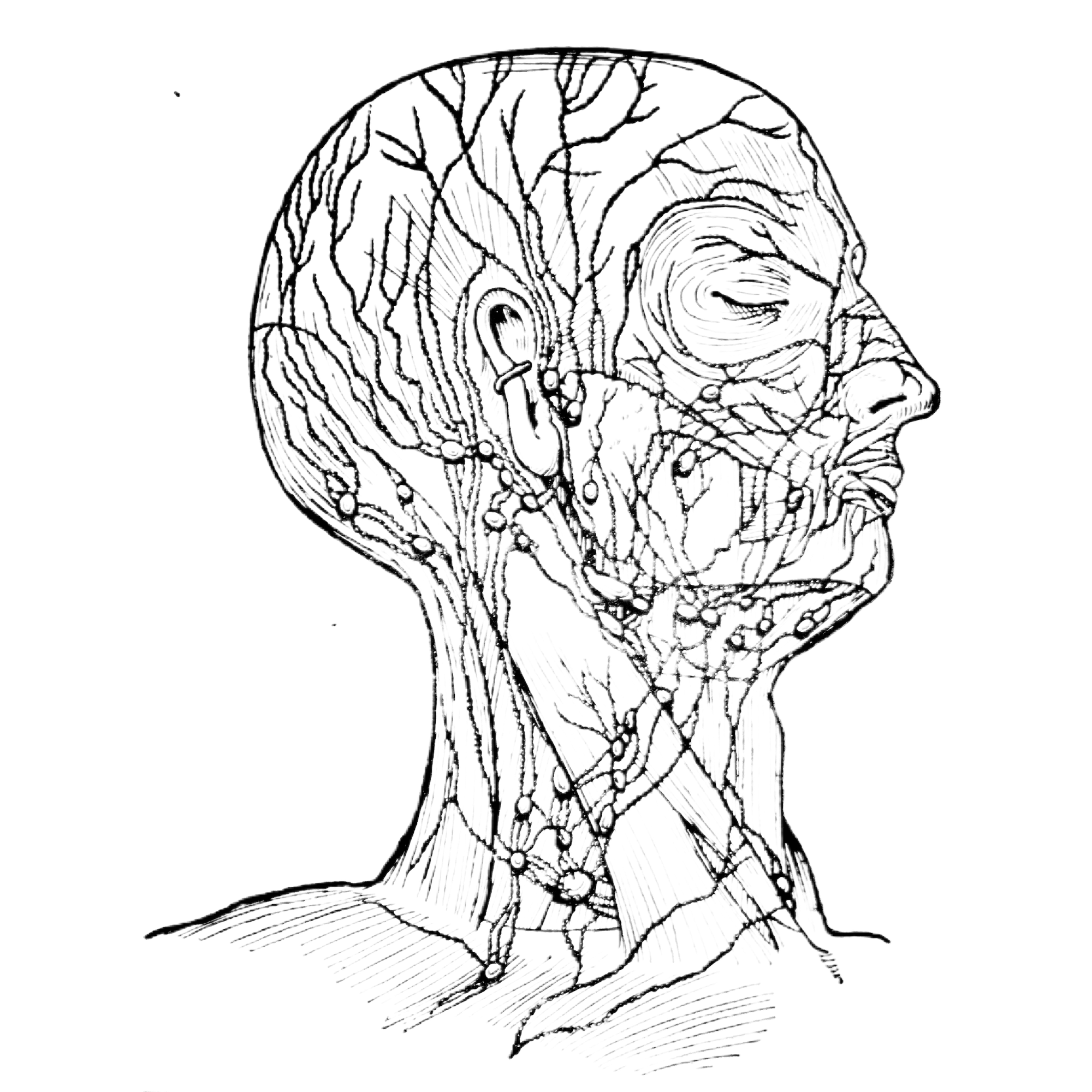

Currently, the process of sending a transaction or voting on chain requires a digital signature, which is usually a simple press of a button to confirm the transaction. Improved signature methods have been coming to fruition lately, such as multisig wallets, which requires multiple pre-set signatures specific to that wallet in order to send a transaction. One potential evolution of multisig wallets is that you can assign each signature to a biometric reader. These could be in the form of a fingerprint, Face ID, DNA swab, your unique neurome (brain image), and/or, if you had some form of brain implant, a unique thought. Multisig wallets can also be used to own and manage a single asset or NFT, which may be the most realistic means of managing an AI, especially in the form of a car, bot, or algorithm.

In order to maximize the speed at which the decision data is transferred from the human to the device, invasive technologies like microchips, nanobots, and/or brain interfaces must be strongly considered. Unfortunately, the Ad Model has destroyed any possibility of public trust in such technologies, and privacy laws in government are sorely needed, but that’s a topic for another day. Put simply, mixing the Ad Model with deeply personal technologies like brain-machine-interfaces is an apocalyptic combination. Thus, devices like Neuralink can’t be sustained in an Ad Model economy; they must be innate to a token-based economic model.

For now, much of the focus within DAOs is on governance philosophy. The emergence of blockchain governance solutions has brought a plethora of different governing structures. One simple way to put this is; would you prefer a DAO governed in a democratic way or one that relies on representatives? While direct democracy is appealing from an equality standpoint, it has downsides. When making a collective decision via a proposal, the population must be educated on the issue and quick to vote. A representative would be knowledgable on the topic and vote quickly, whereas the average voter is likely to contrast this tendency. Representative systems, however, can lead to class separation that encourages inequality, especially if vote-buying is not mitigated. One example of an optimal mix between these two systems of governance may be “liquid democracy”, where each voter can delegate their vote to any other voter they wish, and the vote passes when it has reached a certain threshold. Liquid democracy considered, it will be fascinating to observe the many possible forms of optimal governance structure that are sure to arise in the coming years.

Scalability, ease-of-use, governance structure, and security are all of major importance for constructing DAOs that can match the pace of AI. And it is through the evolution of cryptographic technologies that we can control and mitigate AI’s negative impacts that the world’s most prominent minds have warned against. Scaling DAOs is our ultimate solution.